The future of tax is digital – Are you ready?

Making Tax Digital (MTD) is changing the way businesses report tax to HMRC. For recruitment agencies, this means moving to fully digital tax records and quarterly reporting instead of the traditional annual return.

From April 2026, self-employed professionals and landlords earning over £50,000 per year will need to comply with MTD for Income Tax. By 2027, this extends to those earning over £30,000, with further changes expected beyond that.

How does this affect recruitment agencies?

If your agency works with self-employed contractors, MTD will impact how they manage tax compliance—and agencies that support them will stand out. Additionally, agencies with business expenses that require tax reporting must prepare for a fully digital tax system.

Key changes with MTD

- Quarterly tax reporting – Instead of a single annual return, income and expenses must be reported every three months (deadlines: 7 May, 7 August, 7 November, 7 February).

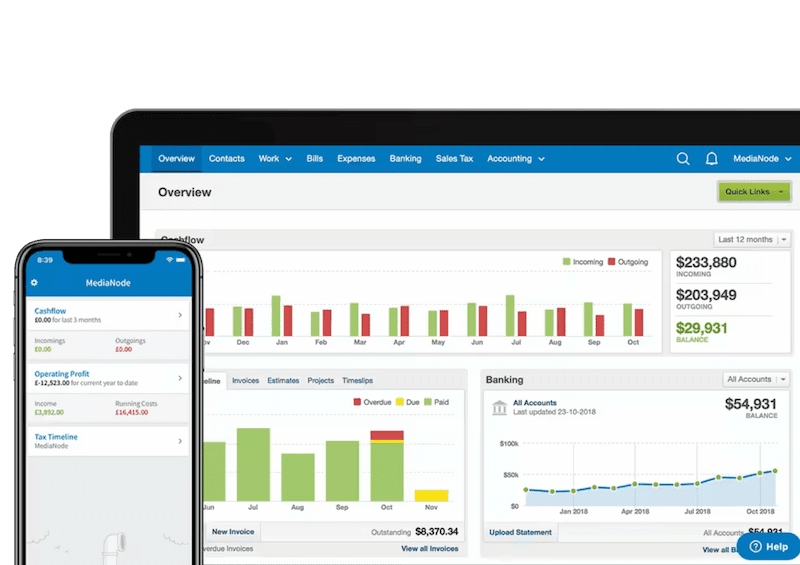

- Digital record-keeping – Spreadsheets alone won’t be enough. You’ll need MTD-compatible software to store and submit financial data.

- Final year-end submission – At the end of the tax year, businesses will submit a final declaration instead of a self-assessment return.

Who needs to comply?

April 2026 – Self-employed professionals & landlords earning £50,000+

April 2027 – Self-employed professionals & landlords earning £30,000+

Future changes – Expected to include those earning £20,000+

How can MTD benefit your agency?

- Supporting your contractors – Helping self-employed workers understand and comply with MTD builds stronger partnerships.

- Improve financial control – Real-time tax tracking ensures better visibility and removes last-minute surprises.

- Save time on admin – Automating tax reporting reduces manual errors and frees up time to focus on core business activities.

- Future-proof your agency – Digital tax reporting is becoming the standard, and early adoption will provide a competitive advantage.

Download your free guide to Making Tax Digital (MTD)

Ready to get ahead? Our step-by-step guide explains everything you need to know about MTD. Get it now by filling in the form below: