Being your own boss offers many advantages, but for many small business owners, the task of managing financial records can feel overwhelming. If you’ve recently become self-employed and are unsure about the types of records you need to maintain, and for how long, this guide provides a straightforward overview.

Why keeping business records is important

Although it may seem like just another administrative task, maintaining clear and accurate records is vital for tracking your business’s cash flow. Additionally, organized financial records simplify the process of submitting your annual Self Assessment tax return to HMRC.

Beyond the practical benefits, keeping accurate business records is a legal obligation. These records must be retained for several years in case HMRC requests an audit, and failure to comply can result in fines of up to £3,000.

Records for Sole Traders and Partnerships

If you’re self-employed as a sole trader or part of a partnership, you’re required to keep records of both your business income and expenses. Additionally, you should track any other personal income for your tax return.

Business income

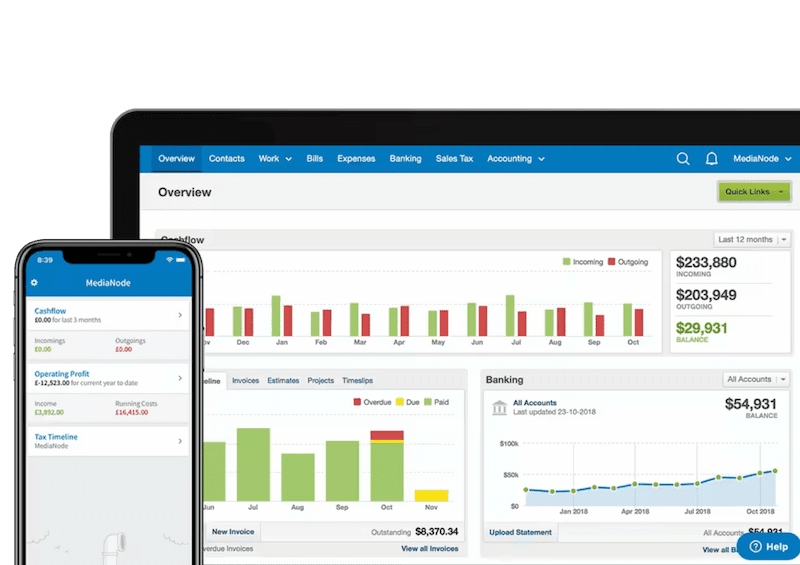

You’ll need to document all sales and income, supported by invoices, receipts, and bank statements. Records can be physical or digital, and using cloud accounting platforms like FreeAgent can simplify this process.

To comply with HMRC guidelines, each invoice must have a unique identifier, along with the date, names and addresses of both your business and the customer. Additionally, the invoice must describe the goods or services provided, the date of delivery, and the amount due.

If your business is VAT-registered, additional details like the VAT amount, your VAT registration number, and the VAT rate for each item must be clearly stated. You can refer to our VAT invoice guide for more specifics.

Business expenses

It’s crucial to keep receipts for all business expenses. These can be in paper form or digital copies such as scanned receipts or photos, as long as all necessary details are legible. You should also keep records of any capital assets your business purchases.

Additional business records

If your business is VAT-registered, you must maintain VAT records. Additionally, if you have employees, you’ll need to keep PAYE records. Don’t forget to record details of any grants you received through the Self-Employment Income Support Scheme (SEISS) during the Covid-19 pandemic.

Personal income

For your tax return, you’ll also need to track personal income, including:

- P45s, P60s, P11Ds, and payslips (if employed in addition to running your business)

- Bank statements showing interest earned

- Dividend vouchers for any UK company dividends received

For a detailed breakdown, consult HMRC’s guidance on personal tax records.

Records for limited companies

If your business is a limited company, your record-keeping obligations are different. In addition to financial records, you must keep certain records about the company itself. HMRC provides specific guidelines on this, and more information is available in our guide to starting a limited company.

How long to keep business records

For sole traders and partnerships, business records must be kept for at least five years following the 31st January submission deadline for the corresponding tax year. For instance, for the 2020-21 tax year, records must be kept until January 2027.

Limited companies must retain records for at least six years after the end of the relevant financial year. If your business is VAT-registered, VAT records must also be kept for at least six years.

For more comprehensive details on record-keeping, you can refer to HMRC’s online guidance.

Keeping on top of these records will not only help your business run smoothly but also ensure you remain compliant with the law.